Is the rise of private equity in horticulture a curse or a blessing? After an afternoon of presentations and discussion, the positive conclusion is that it offers many opportunities above all, and that it is also a necessity for a developing sector. Scale increases and high-tech cultivation systems mean that the capital requirement for growers and suppliers is growing. Private equity can then offer a solution, although it sometimes goes wrong.

Peter Ravensbergen of Wageningen Economic Research opens the afternoon.

Peter Ravensbergen of Wageningen Economic Research opens the afternoon.

Everyone knows the stories where it goes wrong. They are often the ones that make the news. Wim Hulsink of Erasmus University points this out. He studied private equity in horticulture and is one of the seven speakers at the Synergy Meet-Up of the Top Sector Horticulture & Starting Materials on Tuesday afternoon.

Outside the sector, everyone knows Action. The retail chain is a positive example of how entering private equity can work out well for a company. For another retail chain, Hema, the collaboration with a private equity party did not turn out so well. Hema still exists. Horticulture also has examples of companies with which things turned out even worse.

In the vast majority of cases, however, things go well. For the study, the researchers looked at transactions in horticulture from the period 1989-2023. Of the 66 transactions from that period, 39 involved private equity. Most of the transactions took place in 2021: 11 of them.

Wim Hulsink examined private equity in horticulture on behalf of Erasmus University.

Wim Hulsink examined private equity in horticulture on behalf of Erasmus University.

Who do you choose?

Private equity today can be a complement or alternative to bank financing. On behalf of ABN AMRO's research arm, Jan de Ruyter compares financing through the bank with financing through private equity. The bank cannot, may not, and will not finance everything, and then private equity can be a godsend.

Jan advises companies that come into contact with private equity to take a good look themselves at who they are dealing with. Private equity parties often carry out extensive due diligence, but the other way around is not a bad idea either. According to Jan, however, this does not happen very often yet.

Jan de Ruyter (ABN AMRO)

Jan de Ruyter (ABN AMRO)

According to Leo Schenk of Synergia Capital Partners, the fourth speaker during the afternoon, it is already quite common for companies themselves to do proper due diligence on the private equity party that wants to invest in them. As an example, he mentioned Viscon, which eventually joined forces with Synergia Capital Partners, but not before first asking several companies from Synergia's portfolio about their experiences with the private equity party.

Leo Schenk presents on behalf of Synergia Capital Partners, one of the private equity parties present Tuesday afternoon

Leo Schenk presents on behalf of Synergia Capital Partners, one of the private equity parties present Tuesday afternoon

Cooperative equity

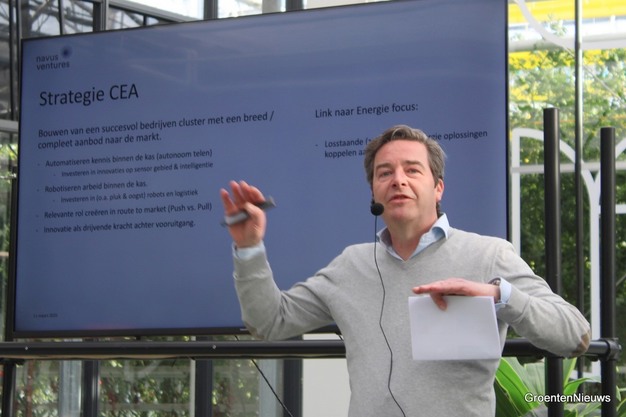

Navus Ventures is another Dutch private equity party with an interest in the agrifood sector. Eduard Meijer told the room about its connection with Lely, known for its milking robots, and its investment course. Navus Ventures is building a successful business cluster with a broad/complete offering to the market. Navus Ventures' investments included Saia Agrobotics, which happened to be in the news recently with a pilot with Growers United, in the 'innovation incubator' Proof.

Eduard Meijer unveils Navus Ventures' CEA strategy

Eduard Meijer unveils Navus Ventures' CEA strategy

Speaking on behalf of Growers United is Finance Director Stefan van Vliet. The cooperative is looking into developing what is called cooperative equity, a form of financing that should work as a growth accelerator for growers. Within the concept, which has yet to be worked out in more detail, growers must be given the option of allowing private equity to step in for an agreed period, after which the grower can continue with all the shares himself after a certain number of years.

In the meantime, a grower has then, for example, thanks to the extra financial possibilities, not only bought his neighbor's 10-hectare greenhouse but also realized the actually needed larger-scale expansion, where without cooperative equity there would have been no money.

Stefan van Vliet, Finance Director at Growers United

Stefan van Vliet, Finance Director at Growers United

Looking to Europe

As a consultancy, Hillenraad Partners has been involved in the growth steps of Agro Care Growers, among others. It is an example of a company that has grown substantially, where economies of scale are clearly visible. These days, the tomato grower no longer looks only at the Netherlands but emphatically at the European market, something Martien Penning of Hillenraad Partners advises all growers who want to maintain their right to exist.

In his presentation, Martien explained what he believes private equity is looking for in horticulture. Private equity, according to him, is looking for value creation. And where, according to the law of three and four, there is still consolidation to be made. Especially in greenhouse vegetables, this is now increasingly visible, with currently half of the Dutch tomato acreage in the hands of just ten growers. In the even more fragmented ornamental horticulture sector, there is much less consolidation, and private equity is also (still?) less present.

Martien Penning, Hillenraad Partners

Martien Penning, Hillenraad Partners