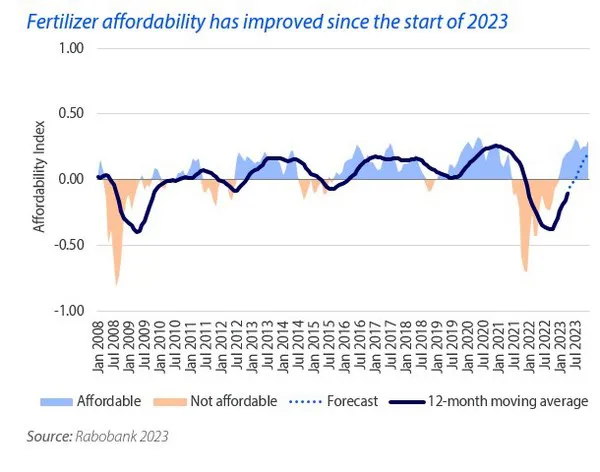

Extreme market volatility and record-high prices severely impacted fertilizer demand in 2022. According to a new Rabobank report, affordability is starting to improve, and a rapid recovery in consumption is possible in some regions in 2023. But in most cases, demand will take a while to return to pre-pandemic levels.

Starting in the first half of 2021, fertilizer prices began to trend higher due to supply constraints resulting from the Covid-19 pandemic. Affordability deteriorated further when fertilizer prices hit new record-high levels after Russia invaded Ukraine. By that time, reasonable commodities prices were the only reason unaffordability didn’t surpass the record set in 2009 during the global economic crisis. “Most fertilizer prices are gradually returning to their historical averages, and in some cases, like urea, current values are below historical levels already,” says Bruno Fonseca, Senior Analyst – Farm Inputs at Rabobank. “On the commodities side, values remain above average in some cases due to tighter stocks. The combination of these two factors is helping affordability.” However, global consumption may take two or three years to recover, and the speed of recovery will depend on how long the current positive cycle lasts.

The Spot Affordability Index, which shows the relative price of a basket of commodities in comparison to a basket of fertilizer, is already in positive territory, with the 12-month moving average trending higher and on track to reach positive territory in the coming months. “When the moving average becomes positive, the negative cyclical period that started at the end of 2021 will be over, which is positive for consumption,” notes Fonseca.

Fertilizer markets outlook

Nitrogen-based fertilizers are very volatile, given their intrinsic connection with oil and natural gas. Nevertheless, the necessity of buying back lost demand sent urea prices on a downward trend before they struck ammonia. The subsequent price mismatch led the ammonia/urea ratio to skyrocket. It wasn’t until natural gas prices began to decline seasonally that ammonia followed suit, nearly halving the ratio. (As a proxy for production costs, a low ratio indicates that urea prices are more likely to remain stable.) Global demand for urea will benefit from price stability around current levels and will slowly rise throughout 2023 as it transitions from sluggish in 2022 to healthier in 2024.

Unlike potash and nitrogen, phosphate prices soared last year after the war in Ukraine began, despite the input’s lower exposure to Russia. Consequently, phosphate consumption during 2022 had a considerable and much anticipated drop. Despite weakened demand, prices remained at elevated levels due in part to reduced Chinese exports. Now that Chinese domestic consumption is coming out of peak season, we might see Chinese volumes return to the global market, depending on the export parity, which might aid downward price movement.

Potash prices continue to fall, but this is failing to raise demand. To be fair, the market has found some equilibrium with some well-timed good demand. Both Brazil and India have attracted volumes in recent months, yet that demand was unable to stop potash prices from dropping, given the ample supply. Regarding the vast supply, reports indicate an increase in Belarusian activity in the global market despite EU and US sanctions. If Belarus raises its market share, as most of the market expects, the increase in exportable volumes would push prices down even further.

For more information: Rabobank

Rabobank

www.rabobank.com