In this week’s issue 580 of the Sunday Spotlight, we revisited our analysis of the eventual normalisation of supply chains, and the potential ramifications on the flows of empty containers. The underlying data for this model comes from the Flexport Ocean Timeliness Indicator (OTI) data, which measures the time it takes from when the cargo is ready at the exporter until the importer takes delivery. Pre-pandemic, the transportation time was 45 days on average, peaking at a transportation time of 112 days in February 2022, which has since been reduced to 88 days, as per the measurement on 26th August 2022.

As transportation times were extended, containers got tied up in the longer supply chain, which is what caused the initial increases in freight rates in the second half of 2020, as not enough empty containers could be moved back out to Asia in time. With a massive shortage of empty containers, carriers had to order new containers to be manufactured in Asia, and these were then fed into the extended supply chains. As transportation time is now getting shorter, these additional containers will be released back out of the supply chain, and they will start to pile up, primarily in Europe and the US. We predicted this development back in February 2022, and this week we analysed whether our prediction was on track.

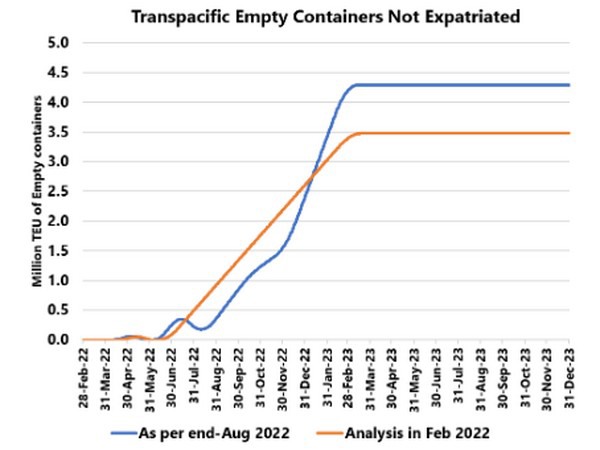

The blue line in the figure above shows our current projection of excess empty containers that will be released into North America, just from the Transpacific trade, and the orange line shows our projection from February 2022. If transportation time is back to “normal” by early next year, we will see the release of 4.3 million TEU of excess containers into North America, which cannot be expatriated, within the planned network operations. This will potentially overwhelm empty container depots in the US, an issue which is already beginning to materialise.

For more information: sea-intelligence.com