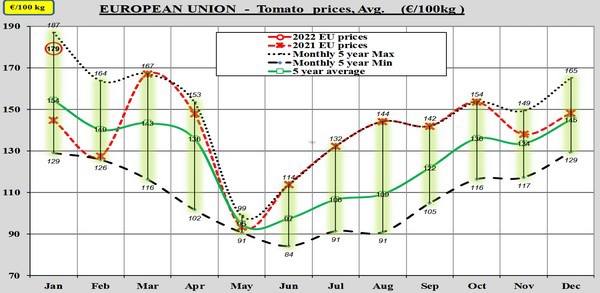

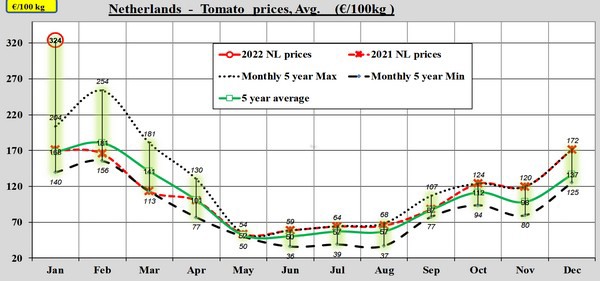

After all the recent happenings and figures, it is no surprise that in January 2022, too, there are plenty of plusses in the tomato market. This year has started where 2021 left off. Once again, the Netherlands, in particular, stands out on the European Commission's dashboard with an average price of €3.24/kg.

The entire Dutch line's average price is high. It has not quite reached the five-year high of €1.87/kg, but at an average of €1.79, 2022 has begun on a higher average price level.

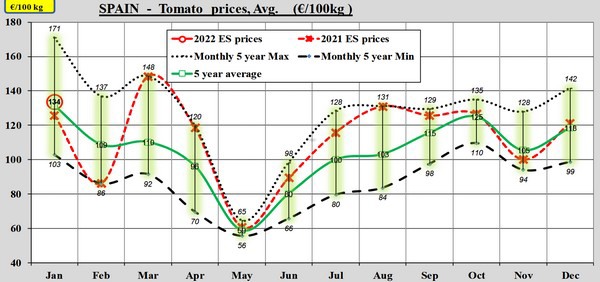

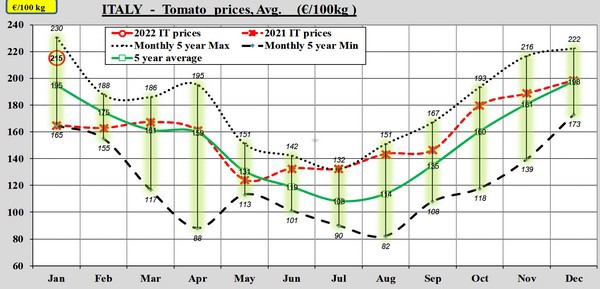

That is true for Italy, but not Spain, where the average price reached €1.34. That average price is in line with that of the last year's and the previous five years' months of January.

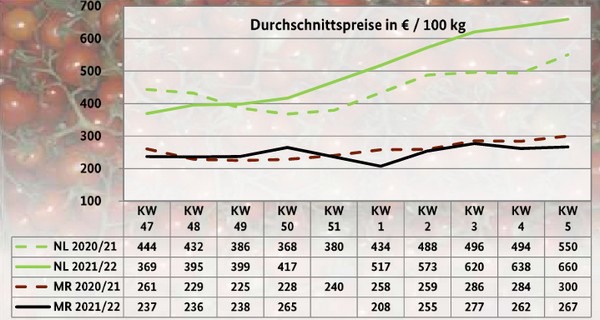

That can be seen in the German wholesale markets too. Spanish tomatoes' average price is higher than in 2021, but not that much higher than that of Dutch tomatoes. Those prices are considerably higher than last year.

The EC tomato dashboard does not include Moroccan tomato prices. But German prices, which are included, indicate what those might be. That is because Moroccan tomatoes are supplied on German wholesale markets. Those figures show that the prices for the Moroccan product do not differ much from last season. Some prices are even slightly lower, such as cherry and round tomatoes.

Dutch and Moroccan cherry tomato prices on German wholesale markets. You can see more figures here.

February

Tomato prices on the European market usually start falling in February. But what is still considered "normal" in the tomato world these days, after prices have been above-average since last summer? Patterns have flown out the window. First of all, because of the global pandemic. But since then, even more so because of tomato virus problems, and now also the energy crisis.

If things go as usual, prices could still rise in February in the Netherlands, as they have for the past five years. Since (sections of) greenhouses are empty and heating and lighting are turned down, volumes are expected to increase later in the season. So, high prices might persist for longer.

Costs

The problem is that costs, not only for energy, have risen enormously by now. Also, many growers have lower volumes. Just consider the Belgian VBT figures. Lower volumes result in higher prices, also on the German wholesale markets. Nevertheless, these high prices are not as significant as they will be later, in the spring. Then volumes will be higher, and if prices remain at current levels, these could make up for some of the damage suffered.

Mutual differences

With all these statistics, however, it is important not to lose sight of the considerable differences between growers. There are currently growers in the Netherlands earning money from the energy craze with their cogeneration units. Other growers, meanwhile, have empty greenhouses because they cannot afford to run their gas boilers.

In both cases, however, growers did not become growers just to stare at their well-running cogeneration unit or empty greenhouse. They want to grow tomatoes. And everyone hopes they can get well back into this soon. And they want to make good money since rising costs necessitate rising prices.

But preferably, proportionally to tomatoes grown elsewhere. Because, if the costs are passed on, there is the risk that the Dutch lit cultivation product from heated greenhouses will be priced out of the market. And that would not help anyone either.

Thus, 2022 promises to become an exciting tomato year.