The longest day has passed, but the tomato production is still high. Not only in the Netherlands and Belgium, but also in all other European markets the local productions are peaking, with the exception of Spain, where the season is over. With a still far from optimal situation in the food service industry, it results in a 'gray market'.

Below cost

And the prospects are not very hopeful either. "The recovery, which has been visible for a while since mid-May, has stagnated and currently is deteriorating with prices sometimes even lower," notes Aad van Dijk, Senior Product Manager Fruit Vegetables at The Greenery.

"There are no real outliers upwards, although the smaller varieties are still doing reasonably well. There sometimes you see a more scheduled cultivation and therefore a somewhat more constant market. However, also here the balance remains unstable.

Demand in the food service industry has picked up slightly, but an increase from about ten percent during corona to thirty or forty percent demand now is insufficient to rectify everything. In round tomatoes and beef tomatoes, for example, there really is hope for a better second half of the season, because the grower is now not even realizing the cost price."

Difficult six months for European tomato growers

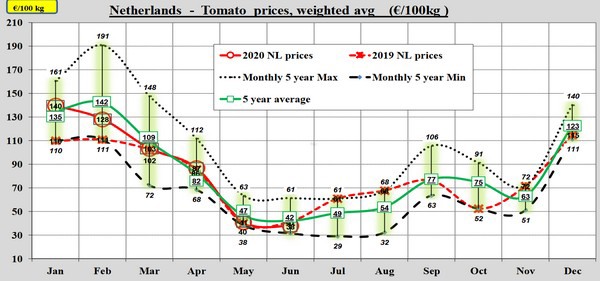

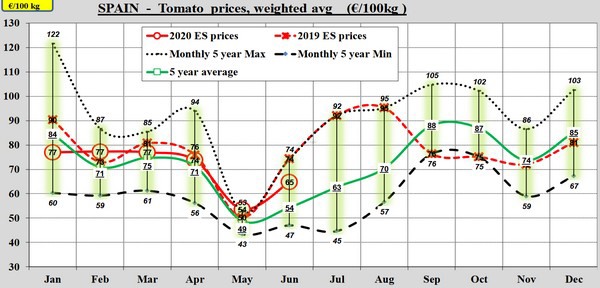

The above-mentioned difficult situation in the Netherlands results in prices that are slightly below the price average for 2019, this according to European market figures. In Spain, the average price is also below that of 2019, although the price is well above the five-year average. The latter can easily be explained by a shrinking acreage in recent years as a result of pressure from the lighted cultivations and Morocco as well as virus pressure.

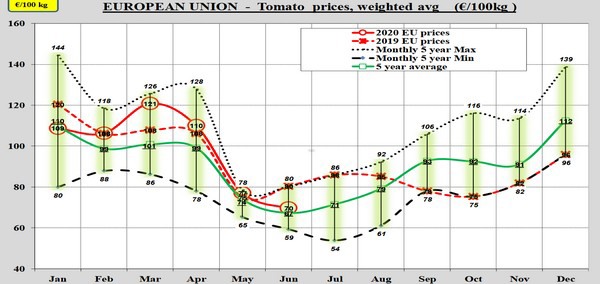

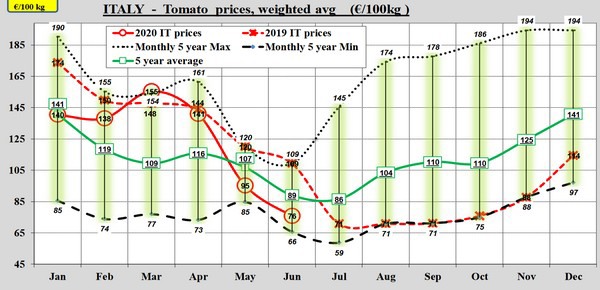

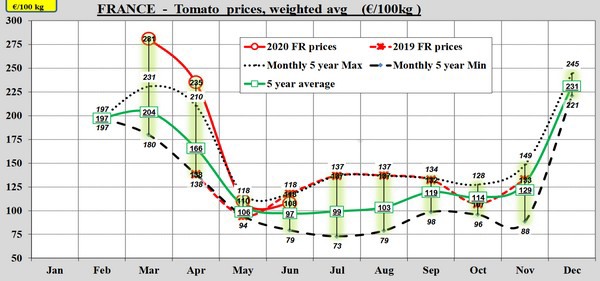

Across the board, prices in the European Union, insofar as collected until June 23 by the European Commission in a series of graphs, are on average well below those of 2019. Especially from mid-May to mid-June, the price is lower compared to 2019. However, the average price is still just above the five-year average.

In the Netherlands, the average price has risen very cautiously since mid-May, as was also concluded in week 24 from a previous update. It can be seen in the figures up to mid-June, but the situation has deteriorated rather than improved.

Prices are sometimes even below cost level, just like in Belgium where in week 27 (one week further than the EU figures) the middle price in individual tomatoes was 33 euro cents and in truss 28 euro cents.

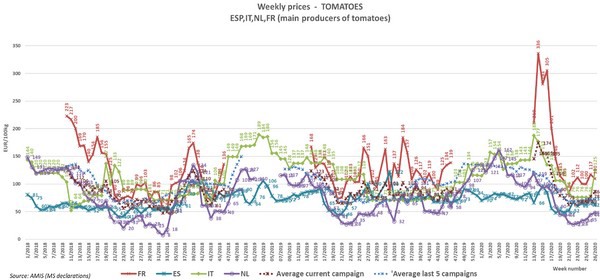

Click here to enlarge. The purple line (Netherlands) rose slightly through week 26.

France does remain above the five-year average

Of the four countries featured in the EU overview, the price in the Netherlands remains the closest to that of 2019, although the average price here is also the lowest and margins are perhaps the smallest.

Italy remains, relatively, the furthest away from the average price of 2019. The gap here is 30 euro cents, compared to 9 euro cents in Spain and 10 euro cents in France, but then with an average price above 1 euro, namely 1.08. Only France realizes a price above the five-year average.

Click here to enlarge the graphs.